Getting accepted into university is a big achievement, but it often comes with new worries like lifestyle, the future and money. This said, one of the most common questions students ask is, “Does a student loan cover all accommodation costs?”

In 2025/26, full-time students living away from home in London can borrow up to £13,762 to help with living costs. That might sound like a lot, but depending on where you're studying, it might not go as far as you’d hope — especially when rent alone can take a big chunk of that.

If you’re a first-generation student (the first in your family to attend university) or seeking up-to-date information, we’re here to help you understand what support is available, what your loan covers, and what to do if your student loan isn’t enough to cover your accommodation.

Keep reading to learn more.

Student Finance England (SFE) is the official student loan company that is responsible for providing your student loans. If you'd like support with living costs while you're at university, you'll need a Maintenance Loan.

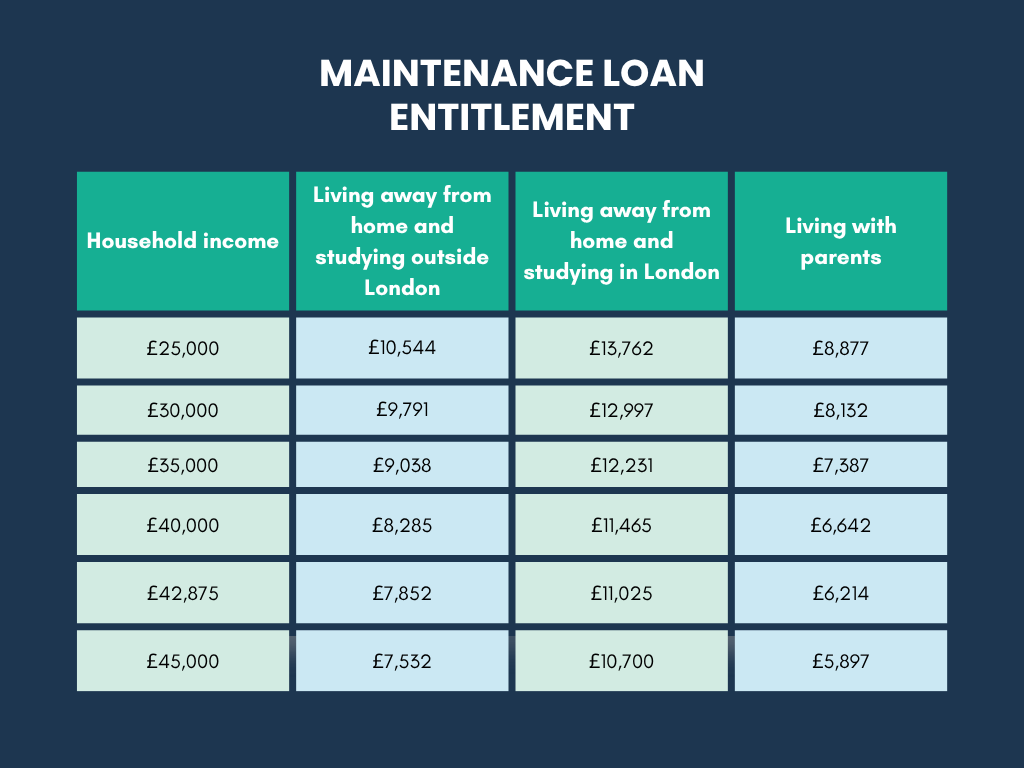

For the 2025-2026 academic year, Maintenance Loans in the UK can range from £3,907 to £13,762.

You’ll be able to find your confirmed amount of student loan in your student finance entitlement letter sent by SFE, or by checking your student finance account. It’s important to note that the amount can differ based on the following factors:

Student living costs are the day-to-day expenses you’ll need to cover while at university. Making sure that you fully account for all of your student bills is essential to making sure that you can focus on your studies without worrying about affordability.

Your student living costs can include:

➡️ Learn more about the cost of student accommodation rent to know how much you may need to pay.

If you’re looking for financial support during your academic journey, there are two types of loans available:

1️⃣ A Tuition Fee Loan

2️⃣ A Maintenance Loan

These are both individual loans, and you can take one without taking the other. Read below to find out what Tuition Fee Loans and Maintenance Loans include.

A Tuition Loan helps cover university accommodation fees, partially or in full. This loan is paid directly to your university rather than via your bank account.

This cost covers lectures, seminars, tutorials, academic services, course admin costs, student well-being, and support on campus. You will only need to start repaying your Tuition Fee Loan when you’re earning over a certain amount.

The cost of Tuition Fees is expected to rise, and you can find more information here.

A Maintenance Loan helps to cover living expenses like rent, food, travel, and study materials. You’ll typically receive a lump sum at the start of each academic semester (or monthly if you’re in Scotland), and the amount will depend on the factors we previously explained.

A Maintenance Loan also needs repaying, but only when you’re above the income threshold.

A Maintenance Loan is designed to help with living expenses, but it may not cover the full cost of student accommodation. Whether it does (or not) will depend on your loan entitlement, your rent, whether bills are included, and any other personal expenses like phone contracts, subscriptions or memberships.

For some, going to university is the first time they will have to have control over their finances. If you’re in this position, a great way to manage your finances is by creating a budgeting plan or by using budgeting tools.

It’s a great way to avoid overspending, avoid financial stress, and account for any unexpected costs.

If you find that your maintenance loan is not enough to cover all of your living expenses, then you’ll be expected to find ways to fill in the financial gaps. This can include:

It’s important to note that if you have a disability, long-term health condition, mental health condition, or learning difficulty, you may be entitled to the Disabled Students’ Allowance.

Also, students who have children or dependent adults may be able to apply for a Childcare Grant, Parents’ Learning Allowance, or Adult Dependants’ Grant.

Understanding student loans and living expenses can be daunting and cause financial anxiety, but knowing how your Maintenance Loan works can massively help.

While your loan may cover some accommodation costs, it might not cover everything, especially if your bills aren’t included in your rent.

Being aware of this, at Stockton Students, we offer all-inclusive bills for student housing in Ormskirk and Liverpool, so you don’t have to worry about paying for utilities on top of your rent. This makes managing your finances easier and more predictable.

To find the perfect student accommodation for your needs, contact us by calling 03301 359065, emailing info@stocktonstudents.co.uk or filling in our quick and easy contact form today and get started on securing your university home!

If you’ve applied for a student loan for accommodation costs (a maintenance loan) and it isn’t enough, you can look into bursaries, grants, scholarships and hardship funds from your university as well as NHS bursaries and teacher training support.

If you’ve not applied for uni yet, carefully consider the location of your uni and the type of accommodation, as this will impact how much your student costs are.